Investor Search

Investor Search makes it easy to find investor firms active in your desired sector.

Building a buyers list or looking for potential acquirers? Our Investors Search is perfect for you. Find relevant strategic buyers, private equity firms, and venture capital firms in your niche market - quickly and efficiently.

You can find investors by:

- Investor type: Select from private equity, venture capital, corporate or all of them

- Investor location: Identify ideal buyers across local, regional, or global markets.

- Portfolio company: Connect with firms invested in your sector, ready to capitalize on similar opportunities.

- Portfolio company location: Discover investors with a preference for companies in specific regions.

Why use the Investors Search?

The Investor Search feature on Inven streamlines the process of finding suitable investors by allowing you to target investors based on their past investment activities.

It saves time by providing detailed insights into investors' portfolios, past acquisitions, investment sizes, and geographical focuses. With customizable filters for investment type, size, industry, and location, you can efficiently connect with potential backers who have shown interest in your field, making your investment search more strategic and effective.

Determine the relevance of an investor

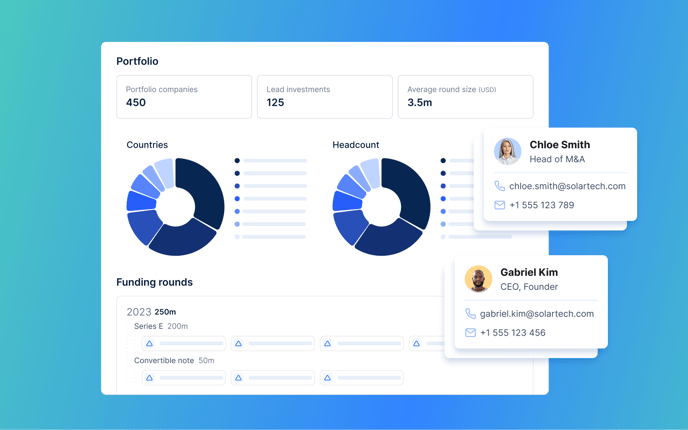

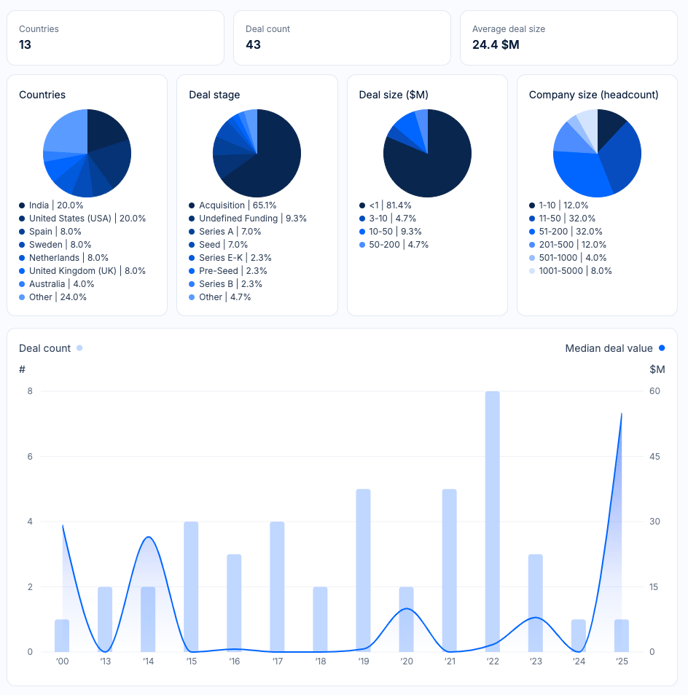

When using Inven's Investor search to find potential buyers or investors, their relevancy will be crystal clear as soon as you view their profile. For example, when you open a VC's, PE's or strategic buyer's profile, you will see the number of historical deals they have completed, along with the average deal value.

Simplified investor assessment by country and company size

In addition, you can find simple, easy-to-understand graphs displaying how their investments are distributed across different countries and company sizes.

Building a Buyers List

Focus on Investor Profiles:

To pinpoint investors with a track record in specific industries, utilize the example company filter by adding a well-known company (for example, Apple). Describe the desired activities or niche in the Portfolio Search to refine your results. This approach will reveal investors that have backed companies similar to Apple, focusing on those within the same niche.

Note: Add portfolio companies or the type of companies the investors should be interested in, not the investors themselves.

Leverage Portfolio Insights:

Analyze investor portfolios to understand their investment preferences and deal sizes.

Refine Your Search:

Use filters for investor type (PE, VC, Corporate), investment size, industry focus, and geographic location.

Example:

To find PE firms interested in Oil & Gas companies, filter for PE investors and select their deal size i.e between $50M and $200M in the energy sector.

Additional Tips:

For optimal results, combine your search by using the Investor Search and Company Search. This approach provides a comprehensive view of potential buyers, allowing you to identify both financial and strategic acquirers.

For example, using the Company Search to identity Strategic acquirers, you can use certain filers such as the 'descriptive search' (i.e "I want to find cloud-based software companies" and adding a Size filter with est. revenue). Then, refine your search by industry, location, size, and other relevant criteria. This will also help you to analyze company profiles to find potential acquirers based on financial performance, market position, and strategic fit.

Consider Geographic Expansion:

Explore neighboring countries for potential investors or acquirers. To do that, just add countries in the Location filter (and any other filters you'd like to add).

FAQ: How can I filter out bigger companies from the results?

If you don't want the biggest corporate companies in your results (for example fortune 500 companies), but still want larger firms, use the Size filter and lower the investment count (i.e from 100+ to 70).

Here's a short video on how to use the Investor Search function:

Here's a short video on how to search within a specific investor company portfolio:

How Investor Search works

- Select your target investor type: VCs, PE firms, or strategic buyers.

- Filter investors by portfolio, focus, location, and deal preferences.

- Review investor profiles and their historical deals.

- Save the best matches to your list.

- Access their contact details and LinkedIn profiles—then reach out!

Frequently Asked Questions (Investor Search)

What is Investor Search?

Investor Search helps you quickly build targeted buyer lists and find the right investors or acquirers based on their portfolio, deal history, investment stage, and thematic focus. Whether you're looking for a strategic buyer, co-investor, or capital partner, Inven surfaces the best-fit firms with the track record to match.

What kind of investors can I find?

You can search across a broad range of investor types, including: private equity firms, venture capital firms, strategic acquirers, family offices, and angel investors.

Can I use this to find potential buyers for a company?

Absolutely. You can use Investor Search to identify relevant acquirers who have a history of buying in a particular sector, size range, or region.

Where does the investor data come from?

Inven pulls investor data from various sources such as deal records, firm websites, press releases, news sources, and social media. We map out investors' investment activity to help you understand who they back and what they're looking for.